4 401k match calculator

100 match on the first 4-6 put in. For example if you retire at age 65 your last contribution occurs when you are actually 64.

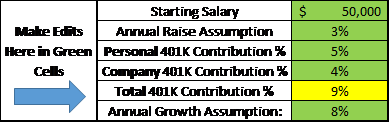

Free 401k Calculator For Excel Calculate Your 401k Savings

Ad A 401k Can Be an Effective Retirement Tool.

. The employer match helps you accelerate your retirement contributions. Some 401k match agreements match your contributions 100 while others match a different amount such as 50. Only 6 of companies that offer 401 ks dont make some sort of employer contribution.

As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your account up to the plans maximum amount. It is mainly intended for use by US.

If you earn 60000 your contributions equal to 6 of your salary 3600 are eligible for. Monthly 401k Balance at Retirement 24M 5000k 10M 15M 20M 25M Now at age 50 at age 65 With employer match Without employer match 401k Balance 00 in total at retirement. After that loading period youll drop your contribution election to the minimum required for your employer match which will continue through the rest of the year while staying below or at the annual contribution limit.

See the impact of employer contributions different rates of return and time horizon. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. For example if you pay 250 and your employer will match this with 125 then enter 50 here.

401k Calculator Project how much your 401 k will give you in retirement. 3 of employee compensation regardless of employee deferrals. A 403b457401k can be one of your best tools for creating a secure retirement.

This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck. You only pay taxes on contributions and earnings when the money is withdrawn. Use this calculator if you do not have an employer match.

Employers might match 25 50 or even 100 of an employees contribution up to a set percentage of the employees salary. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. Apply your companys match percentage to your gross income for the contribution pay period.

Evaluate how much your employer will contribute. And the more money you contribute to your 401 k account the more your company may also contribute. 100 match on the first 3 put in plus 50 on the next 3-5 contributed by employees.

Current 401 k balance The starting balance or current amount you have invested or saved in your 401 k. Assume that your employer matches 50 of your contributions equal to up to 6 of your annual salary. Brought to you by Sapling.

It is the ideal way to see if your retirement plans are on track. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. According to the BLS only 56 of employers even offer 401 k plans and among those 49 match 0 41 will offer a match equivalent to 0-6 of the employees salary and 10 will offer a match of 6 or more.

If this employee earned 60000 the employer would contribute a maximum of 1800 to the employees 401 k that year. Ad A One-Stop Option That Fits Your Retirement Timeline. If your benefits see your contributions matched 100 it means that for every dollar you set aside for retirement your employer will match that with another dollar up to the limit.

Annual rate of return. Reviews Trusted by Over 20000000. This calculator tells you what percentage to set your contribution election at to load your 401k as much as possible over a time period you specify eg.

Compare 2022s Best Gold IRAs from Top Providers. The Growth Chart and Estimated Future Account Totals box will update each time you select the Calculate or Recalculate button. Some offer dollar-for-dollar matches where your employer contributes a dollar for every dollar you put in up to the maximum contribution percentage.

Plus many employers provide matching contributions. Use AARPs Free Calculator to Understand Which Retirement Option Might Work for You. Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

Federal 401k Calculator or Select a state This federal 401k calculator helps you plan for the future. The most common formulas for 401 matching contributions are. Automated Investing With Tax-Smart Withdrawals.

401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will result in a penalty. Your 401k plan account might be your best tool for creating a secure retirement. Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment.

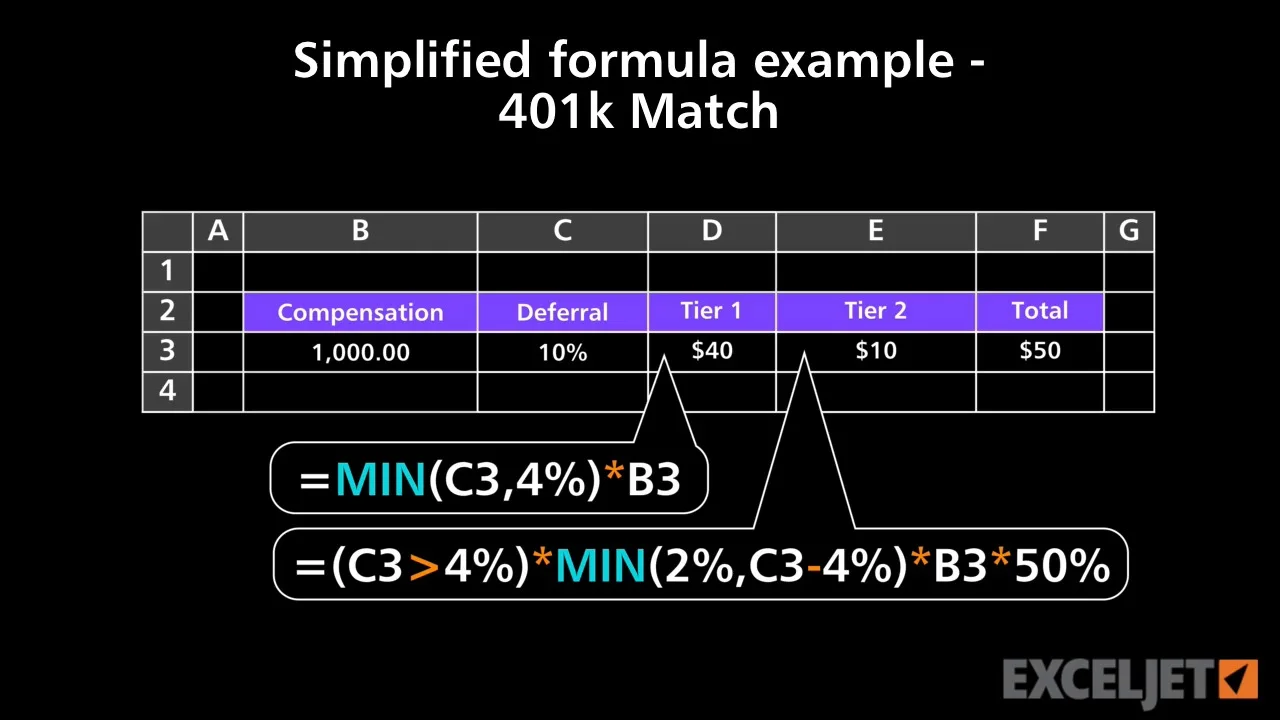

For example an employer may match up to 3 of an employees contribution to their 401 k. How Much Is A 4 401k Match Complex formula example 401k Match The median 401 match is 4 of the employees pay according to Vanguard but every companys system is different. A percentage of the employees own contribution and a percentage of the employees salary.

So if you have a employer that matches 6 or more of your 401 k contribution that is extremely good. Offering a matching 401k plan to your team is a great way to attract. Ad Ready To Turn Your Savings Into Income.

This calculator assumes that the year you retire you do not make any contributions to your 401 k. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and employers contribution information along with your estimates for annual salary hike rate rate of return on investments and retirement age to determine. For example if your employer matches up to 3 percent of your gross income multiply your gross income by 3 percent 03 or the amount of your personal contribution if you contribute less than 3 percent of your own compensation.

Imgur The Most Awesome Images On The Internet Flow Chart Chart Of Accounts Finance Advice

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Doing The Math On Your 401 K Match Sep 29 2000

A Retirement Calculator Calculates How Much You Need To Save To Ensure A Smooth And Comfortable R Retirement Calculator Financial Calculator Financial Planning

401k Contribution Calculator Step By Step Guide With Examples

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Investing

Customizable 401k Calculator And Retirement Analysis Template

401k Contribution Calculator Step By Step Guide With Examples

Excel Tutorial Simplified Formula Example 401k Match

401k Contribution Calculator Step By Step Guide With Examples

Explainer How Does Employer 401 K Matching Work Ellevest

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k